ICO stands for Initial Coin Offering, also called a token sale or initial token offering. An ICO is an event where a new blockchain project raises money by offering network tokens to potential buyers. Unlike IPOs, no equity is for sale. Buyers receive tokens on the network but do not own the underlying project intellectual property, legal ownership, or other traditional equity traits unless specifically promised as part of the sale. The expectation of profit (if there is one) comes from holding the token itself. If demand for use of the new network increases, then presumably so will the value of owning the token.

In this chapter, we are going to cover ICOs, how they came about, and the critical aspects that happen as part of executing one. ICOs continue to evolve, but many events and deliverables have become expected and even mandatory for success.

The first ICO was developed in 2013 by Mastercoin. Mastercoin held that their token, such as bitcoin, would increase in value and at least a few others agreed. Mastercoin held a month-long fundraiser and ended up raising about $500,000, while afterwards the Mastercoin overall market cap appreciated to as high as $50 million. The ability to raise substantial capital without going through traditional channels began to spark a flurry of activity.

The following year, the Ethereum network was conceived and held its token sale. Wth the birth of this network, the difficulty of launching a new token decreased substantially. Once the Ethereum network was stable and had established a critical mass, ICOs began to happen regularly. During the next two years, ICOs began to happen more and more frequently.

Some notable projects from this early period include:

- Ethereum: $18 million

- ICONOMI: $10.6 million

- Golem Project: $10 million

- Digix DAO: $5.5 million

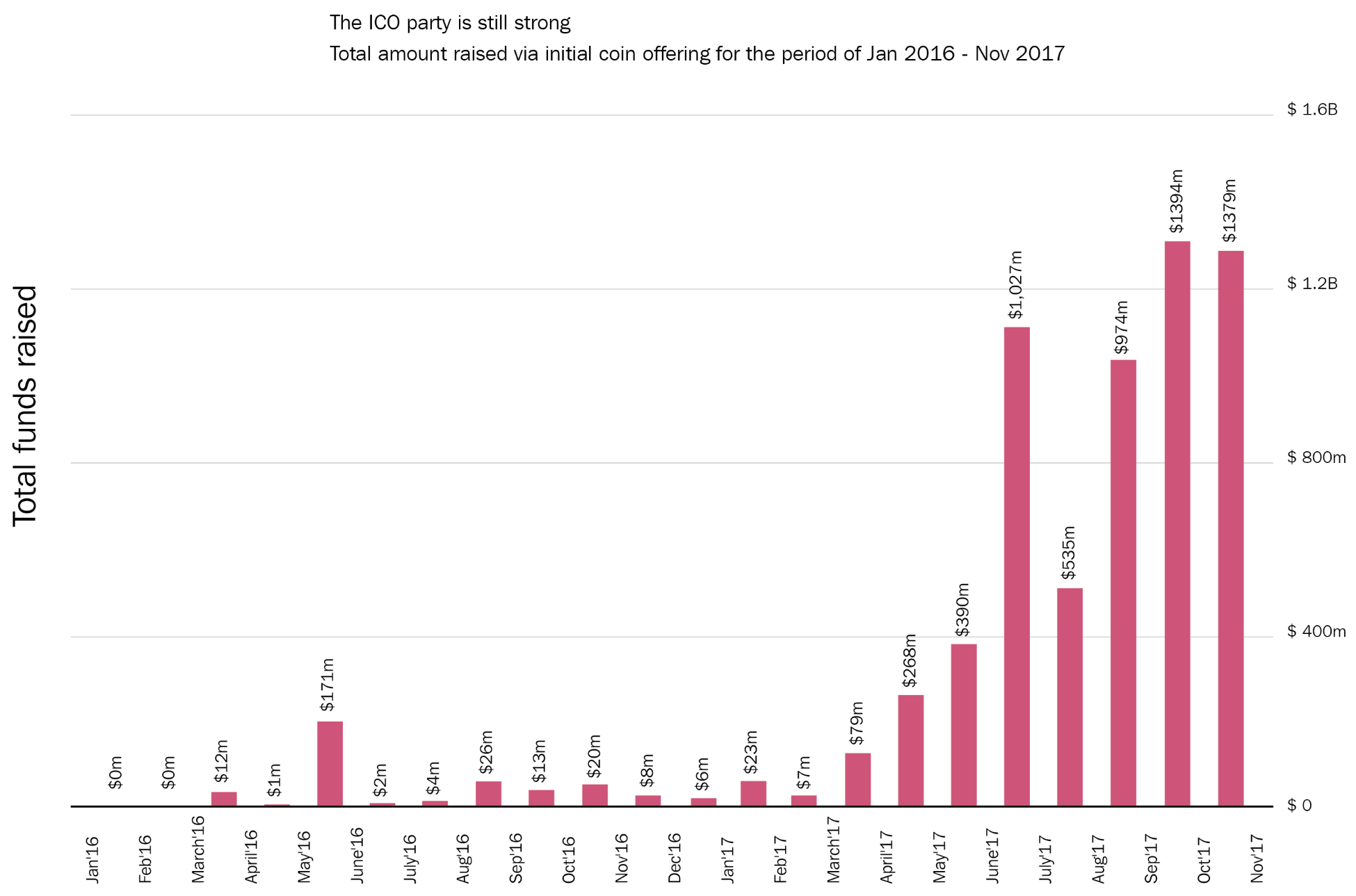

In 2017 the pace of ICOs accelerated, as did the amount of money raised. Here are some of the major projects from 2017:

- Filecoin: ~$257 Million USD

- Tezos: ~$236 Million USD

- EOS: ~$200 Million USD

- Bancor: ~$153 Million USD

There are now over, 1500 cryptocurrencies and more are released regularly. New projects being released at a rate of around 100/month. The topics that we will be covering in this chapter are as follows:

- The current state of the ICO market

- Typical aspects of an ICO campaign

- Issues with ICO's and blockchain projects