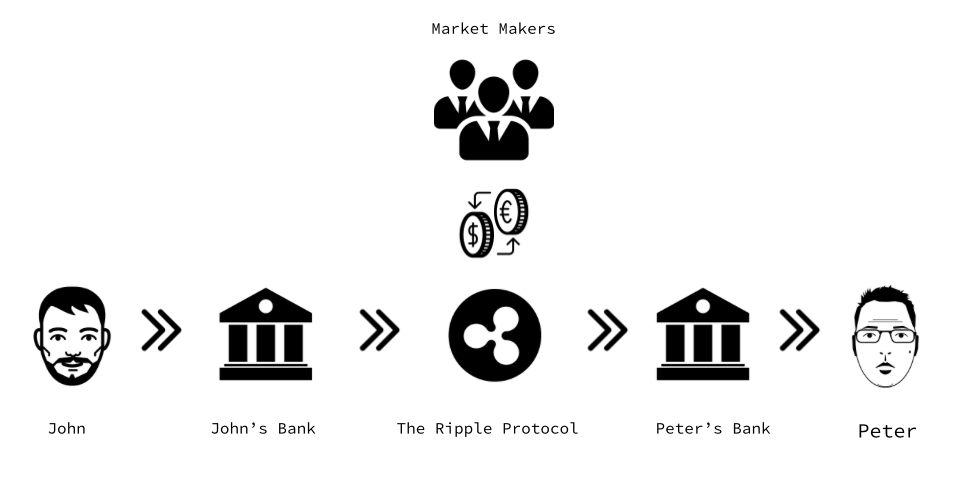

Here's how money moves across borders through the Ripple protocol:

- John's bank would use Ripple's system to initiate the USD to EUR exchange. Market makers will compete by posting bids.

- Ripple's system is optimized to select the cheapest offer. The market maker will buy USD from John's bank and Ripple will transfer Euros from the market maker to Peter's account. These transactions are atomic, which means that both of these transactions happen simultaneously or they don't happen at all.

The following image depicts the flow of money from John's bank account to Peter's bank account through The Ripple Protocol:

Ripple reduces transfer time from days to a few seconds. This is because the transfer happens without intermediaries and the settlement process requires no human intervention. The average transaction fee in Ripple is around $0.0006; that's a significant reduction of cost.

The important point to note here is that users need not exchange Ripples. Ripple can be seamlessly plugged into a banks' systems. Hence, end users such as John and Peter don't have to interact with Ripple's blockchain. Now, let's go deep into the Ripple protocol and study how it works.