Let's consider a simple example where company X wants to send company Y €500. However, since company X is based in the U.S., they have a U.S. bank account. Company Y has a bank account in Europe. Now, in order for the transfer to be complete, company X's bank should exchange dollars for euros and send it to company Y's bank account.

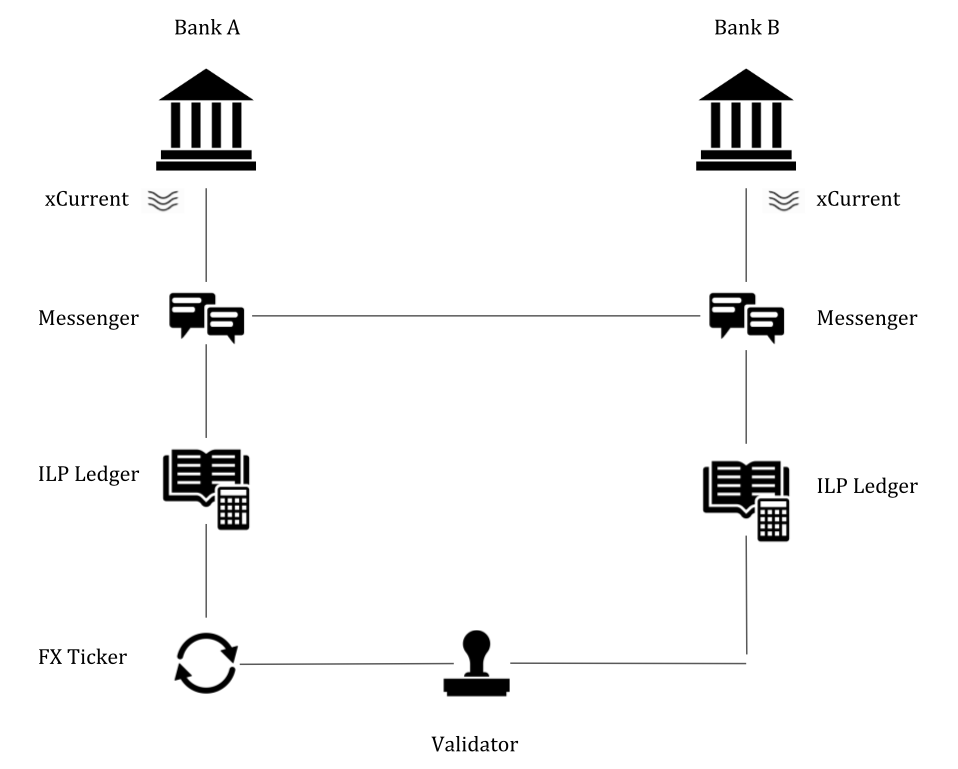

This is where xCurrent software plays an important role. Banks can provide each other with liquidity using xCurrent's ILP ledger and FX ticker components. They can set an exchange rate through and leave xCurrent to manage the heavy lifting of currency exchange and the settlement process.

Before making the transaction, banks will interact with each other through xCurrent's messenger component. They verify their customer's identity and carry out Anti Money Laundering checks. Later, company X's bank will query to find out the processing fee and the exchange cost. They find out the exchange rate of EUR/USD is at 1.5 and the processing fee would be $10. Company X also needs to bear the processing cost of their bank, which is $10.

Hence, the total amount would be $770 ((500 * 1.5) + 10 + 10). Company X agrees to the amount and the transaction is initiated. The sender bank takes the processing fee of $10. The amount that needs to be transferred is $760.

These funds are put on hold until the beneficiaries bank shows proof that it has put the same funds on hold to credit company Y.

Now both banks exchange cryptographic proofs that the amount is on hold. Ripple validators receive this proof and verify it. Once the validator confirms the proof, it directs the ILP ledgers of both banks to release and transfer funds. Hence, an amount of $770 would be debited from company X's account. Simultaneously, company Y's account is credited with €500. This process is atomic, either both of these transfer happens or nothing happens. Hence, the chances of settlement failure are minimized.

The following diagram describes how different components of xCurrent integrate with the traditional banking system to enable cross-border payments: